"SBA Thanks You For All The Fish" (santabarbarianlsx)

"SBA Thanks You For All The Fish" (santabarbarianlsx)

08/31/2020 at 14:21 ē Filed to: None

1

1

27

27

"SBA Thanks You For All The Fish" (santabarbarianlsx)

"SBA Thanks You For All The Fish" (santabarbarianlsx)

08/31/2020 at 14:21 ē Filed to: None |  1 1

|  27 27 |

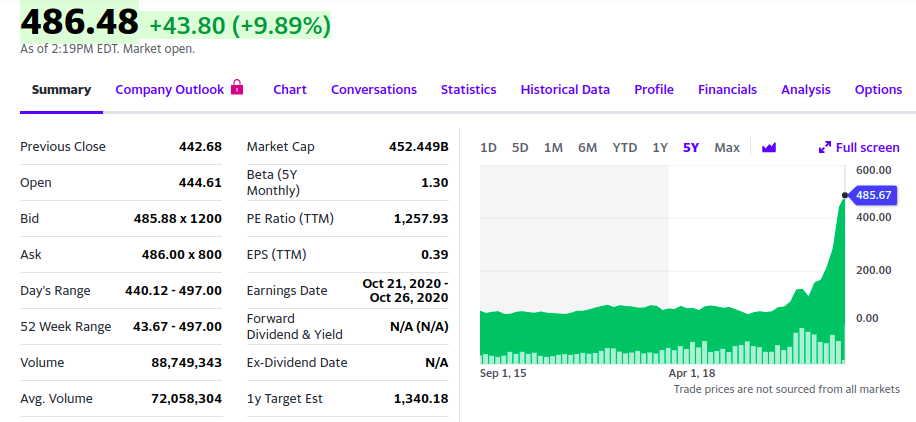

I think my favorite number here is a TRAILING P/E (typically ď20" for industrial, manufacturing stocks) of well over 1200. Normal, just Super-Giga-Normal.

This is what we'll show whenever you publish anything on Kinja:

> SBA Thanks You For All The Fish

This is what we'll show whenever you publish anything on Kinja:

> SBA Thanks You For All The Fish

08/31/2020 at 14:27 |

|

IDK what is going on here, but sell and sell right now. Probably. Like I said...

someassemblyrequired

> SBA Thanks You For All The Fish

someassemblyrequired

> SBA Thanks You For All The Fish

08/31/2020 at 14:27 |

|

Iím stockpiling popcorn for when the music stops

For Sweden

> SBA Thanks You For All The Fish

For Sweden

> SBA Thanks You For All The Fish

08/31/2020 at 14:30 |

|

stonks.png

ADabOfOppo; Gone Plaid (Instructables Can Be Confusable)

> SBA Thanks You For All The Fish

ADabOfOppo; Gone Plaid (Instructables Can Be Confusable)

> SBA Thanks You For All The Fish

08/31/2020 at 14:31 |

|

What company?

SBA Thanks You For All The Fish

> someassemblyrequired

SBA Thanks You For All The Fish

> someassemblyrequired

08/31/2020 at 14:34 |

|

Iím sincerely worried that, when the bubble pops, it really could spill over into panic selling in the broader markets.

notsomethingstructural

> SBA Thanks You For All The Fish

notsomethingstructural

> SBA Thanks You For All The Fish

08/31/2020 at 14:38 |

|

Most investors are treating it as an outlier and I donít think even a significant (~25-50%) change in valuation will change anyoneís mind. Bulls think the upside is there but its exceeding short-term targets, bears are short and have been for some time. I think a lot of people arenít looking to participate in it, and a lot of others wonít sell in a dip. It might pop but I donít see any spillover like the dot-com years where it fundamentally challenged how tech companies are valued.

Aremmes

> ADabOfOppo; Gone Plaid (Instructables Can Be Confusable)

Aremmes

> ADabOfOppo; Gone Plaid (Instructables Can Be Confusable)

08/31/2020 at 14:38 |

|

TSLA

BrianGriffin thinks ďreliableĒ is just a state of mind

> SBA Thanks You For All The Fish

BrianGriffin thinks ďreliableĒ is just a state of mind

> SBA Thanks You For All The Fish

08/31/2020 at 14:44 |

|

Retail investors are really fucking with the stock market. Commission-free trades are one of these things that sound like a good idea in theory, but have catastrophic effects in practice.†

SBA Thanks You For All The Fish

> notsomethingstructural

SBA Thanks You For All The Fish

> notsomethingstructural

08/31/2020 at 14:59 |

|

Maybe, but I was shocked to see how much institutional money had piled into Uber and Lyft. If Tesla gets knocked down a peg or twenty? I think portfolio managers are going to look hard at other unicorns they hold...

It could set off a wave of selling.

In theory the LTCM meltdown started with one class of Russian debt...† Then the contagion grew.

SBA Thanks You For All The Fish

> BrianGriffin thinks ďreliableĒ is just a state of mind

SBA Thanks You For All The Fish

> BrianGriffin thinks ďreliableĒ is just a state of mind

08/31/2020 at 15:01 |

|

The bizarre thingó as seen on a couple of previous ďcorrectionsĒ in TSLAó is that the big fund holders always seem to know more about whatís coming than the retail ďinvestorĒ. That last big drop into the sub 200s? There was an immense amount of institutional selling in the week prior to that announce ment.

Itís always the small investors left holding Le Bag.

MM54

> SBA Thanks You For All The Fish

MM54

> SBA Thanks You For All The Fish

08/31/2020 at 15:23 |

|

When I get my time machine working, after I buy that bitcoin in 2007 I passed on and sell half of it when it hit 20k a couple years ago, I may stop by late 2019 to put that money into TSLA.

PatBateman

> SBA Thanks You For All The Fish

PatBateman

> SBA Thanks You For All The Fish

08/31/2020 at 15:23 |

|

[This rant redacted due to this FINRA rule ]

tl;dr I have nothing to add (that Iím allowed to add) that you havenít already said.

facw

> SBA Thanks You For All The Fish

facw

> SBA Thanks You For All The Fish

08/31/2020 at 15:24 |

|

Well the inv estors are clearly looking at it as a growth stock, so itís not surprising its P/E is way out of line with established industrial stocks. That said, their market cap is like 2.5x Toyotaís (which is already vastly more than other big players like VAG, GM, Ford, etc.) so you wonder how big people think Tesla can grow? Itís not like they are going to have the electric market all to themselves, and most analyses put their self-driving tech significantly behind other players in that space.

Is this just retail investors? Honestly it doesnít seem like there are enough of them to move it this much (especially since I would hope most of them arenít just throwing everything at Tesla). I suppose right now the price is high, so you canít blame anyone for owning, but someoneís going to be in bad shape when the music stops.

SBA Thanks You For All The Fish

> facw

SBA Thanks You For All The Fish

> facw

08/31/2020 at 15:36 |

|

Iím curious what the make-up of ownership is today. I assume a lot of big funds have piled into it now that itís ďlegití.

Certainly thereís the ďperceptionĒ of fast-track growth, but the slowdown actually began long b efore COVID hit...

SBA Thanks You For All The Fish

> facw

SBA Thanks You For All The Fish

> facw

08/31/2020 at 16:03 |

|

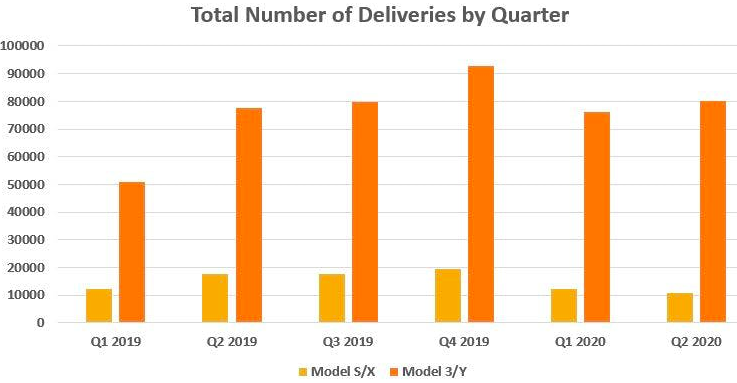

By the way, on the ďoh itís a monster growth story frontĒ??

This is what the last few quarters of unit-deliveries look like. Iím still squinting to discern the ďmonster growth storyĒ in here...

facw

> SBA Thanks You For All The Fish

facw

> SBA Thanks You For All The Fish

08/31/2020 at 16:17 |

|

Well obviously the monster growth is coming in the future, or the P/E would look less stupid...

But yeah, Iíve got no idea where people think that growth will come from. The automotive market place is very competitive, so even if Telsa does well they arenít going to have a huge share of the market. Tesla has positioned itself as a luxury brand (5th best-selling in the US after Mercedes, BMW, Lexus, and Audi), but is being valued as being worth more than $100B more than all those luxury brands (and their parent companies!) put together. And itís not like Tesla has any special sauce that allows them to be significantly more profitable building these cars, they have just been more aggressive, but you can be sure other brands will challenge them, both at the high and low end if their market share continues to (slowly) grow.

WilliamsSW

> BrianGriffin thinks ďreliableĒ is just a state of mind

WilliamsSW

> BrianGriffin thinks ďreliableĒ is just a state of mind

08/31/2020 at 16:46 |

|

Also everyone should be able to trade on margin because that will enable everyone to make lots of money. Itís only fair.

BaconSandwich is tasty.

> SBA Thanks You For All The Fish

BaconSandwich is tasty.

> SBA Thanks You For All The Fish

08/31/2020 at 17:18 |

|

Iím generally a fan of Tesla (not Elon) and what they are doing, but I donít get the hype over the stock price. I think itís waaaay overvalued for what it is. I think at this point itís more of an emotional (than logical) purchase. Itís not going to stay that high forever, and someone is going to be left holding the bag, as others have said. And it isnít going to pretty.

Manwich - now Keto-Friendly

> SBA Thanks You For All The Fish

Manwich - now Keto-Friendly

> SBA Thanks You For All The Fish

08/31/2020 at 17:20 |

|

And for a high-growth tech that is growing the way Tesla is , a normal PE would be around 100-200... not 1200+.

Even though Iím a fan of Tesla, the share price is Ď left-our-solar-systemí high.

It reminds me of the dot com boom.

I suspect pure momentum day traders are whatís driving the price now.

Or itís one hell of a short squeeze.

Or itís in anticipation of how sales will increase in the coming year after the Berlin plant is online and how Tesla develops the plant in China... not to mention the new plant they are working on in Texas

Once these plants get built, it will lead to an increase in sales, but I donít believe it will be an increase that justifies the current share price.†

Manwich - now Keto-Friendly

> PatBateman

Manwich - now Keto-Friendly

> PatBateman

08/31/2020 at 17:22 |

|

ďtl;dr I have nothing to add (that Iím allowed to add) that you havenít already said.Ē

OBVIOUSLY your original rant was about how TSLA shares werenít high enough!!!

:-p

someassemblyrequired

> SBA Thanks You For All The Fish

someassemblyrequired

> SBA Thanks You For All The Fish

08/31/2020 at 19:52 |

|

Yeah, Iím mostly out at this point.†† I might miss out, but I like sleeping at night.

SBA Thanks You For All The Fish

> someassemblyrequired

SBA Thanks You For All The Fish

> someassemblyrequired

08/31/2020 at 20:02 |

|

The damn thing ran up another $50 tonight AFTER THE CLOSE.† Itís nutty.† It will burst at some point.

notsomethingstructural

> SBA Thanks You For All The Fish

notsomethingstructural

> SBA Thanks You For All The Fish

08/31/2020 at 21:00 |

|

Uber and Lyft absolutely do not belong in the same tier as Tesla. Not in a million years. 2021 Tesla is 2020 Uber/Lyft on the upside, and 2021 Tesla is 2020 WeWork on the downside. Thereís already been significant institutional pullback on rideshare so I think thatís baked out of the equation a bit

someassemblyrequired

> SBA Thanks You For All The Fish

someassemblyrequired

> SBA Thanks You For All The Fish

08/31/2020 at 21:18 |

|

gonna make Ď87 look like a field day

SBA Thanks You For All The Fish

> notsomethingstructural

SBA Thanks You For All The Fish

> notsomethingstructural

08/31/2020 at 21:20 |

|

!!! UNKNOWN CONTENT TYPE !!!

Heh. I may need to use that...

SBA Thanks You For All The Fish

> someassemblyrequired

SBA Thanks You For All The Fish

> someassemblyrequired

08/31/2020 at 21:21 |

|

All those orders that day were still processed by handó the brokersí clerks couldnít clear the trades fast enough. EVERYBODY wanted out right now.

I donít even remember what the trigger was?† Some butterfly coughed in Burma I think...† Made a hurricane in Jersey City

notsomethingstructural

> SBA Thanks You For All The Fish

notsomethingstructural

> SBA Thanks You For All The Fish

08/31/2020 at 21:31 |

|

spread the love baby